Ever stared at a stock chart and felt lost? You’re not alone. Trading patterns are like secret codes in the market. They help predict where prices might go next. This intro will show you seven key charts that could boost your profits. 3

Ready to crack the code?

Key Takeaways

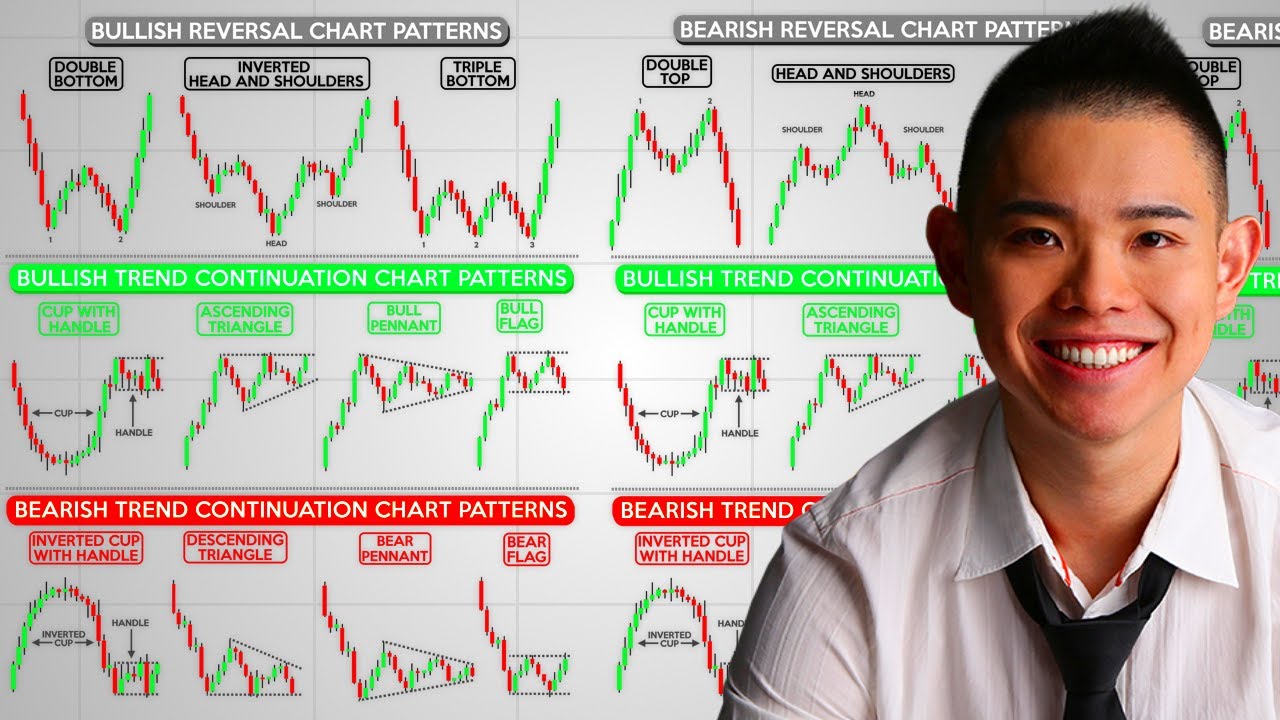

Trading patterns are visual clues in price charts that help predict future market moves. Common patterns include head and shoulders, double top/bottom, and cup and handle.

Candlestick patterns like hammers, doji, and engulfing patterns offer quick insights into market sentiment and potential price changes.

Advanced patterns such as triangle formations, golden crosses, and bear traps can signal major trend shifts or trap unwary traders.

Combining volume analysis, moving averages, and price patterns improves trading decisions. High volume often confirms the strength of breakouts and trend changes.

No pattern is foolproof. Always use stop-loss orders, manage risk, and confirm signals with multiple indicators for better trading results.

Table of Contents

Basics of Chart Patterns

Chart patterns are like road signs for traders. They show where prices might go next – up, down, or sideways.

Role of Chart Patterns in Trading

Chart patterns are the secret sauce of trading. They help traders spot market trends and make smart moves. These visual clues show how prices might behave in the future. Traders use them to decide when to buy or sell.

It’s like reading a map of the market. 1

Charts are the footprints of money. – Anonymous

Patterns come in three flavors: continuation, reversal, and bilateral. Continuation patterns hint that the current trend will keep going. Reversal patterns suggest a change is coming.

Bilateral patterns? They’re tricky – the price could swing either way. Smart traders use these clues to boost their profits and cut losses. It’s not magic, but it sure feels like it sometimes! 2

Common Chart Patterns

Now that we know why chart patterns matter, let’s dive into the common ones traders use. These patterns pop up often in price charts and can give us clues about where the market might go next. 3

The Head and Shoulders pattern is a big deal. It looks like… well, a head with two shoulders. You’ll see a big peak in the middle, with two smaller peaks on each side. This pattern often signals a trend change. 3 Double Top and Double Bottom patterns are also key. They show up as two peaks or two valleys and can hint at a market flip. 2 Other common patterns include the Rounding Bottom, Cup and Handle, Wedges, and Triangles.

Each has its own shape and meaning for traders. Knowing these patterns can help you spot good times to buy or sell.

Essential Chart Patterns for Traders

Chart patterns are the bread and butter of trading. They’re like road signs for your money – pointing the way to potential profits. Let’s dive into some key patterns that’ll help you spot golden opportunities…and avoid costly pitfalls.

Head and Shoulders

The Head and Shoulders pattern is a trader’s go-to tool. It’s simple to identify and powerful for forecasting market shifts. 4 Imagine a tall peak with two smaller ones on each side, all resting on the same support level.

That’s your Head and Shoulders pattern! Traders rely on it as it often hints at a downward trend – when prices might start falling. 5

This pattern is more than just eye-catching. It’s a practical tool for making informed trades. The ‘neckline‘ – the support level where all peaks connect – is crucial. If the price drops below it, take note! It’s frequently a hint that sellers are gaining control, and prices might decline.

But keep in mind, no pattern is foolproof. Always use additional indicators to confirm your observations.

Double Top and Double Bottom

Double Top and Double Bottom patterns are like twins in the trading world. They show up when prices hit the same high or low twice. Double Tops look like an “M” on charts. They hint that bulls are losing steam. 6 Double Bottoms form a “W” shape. They signal bears might be giving up. 7

These patterns pack a punch for profit-seekers. In a Double Top, prices drop below support after two peaks. That’s when smart traders might sell. For Double Bottoms, prices bounce off the same low twice.

Then, they break above resistance. That’s often a good time to buy. Next up, let’s check out the Rounding Bottom pattern.

Rounding Bottom

Moving from double tops and bottoms, let’s explore another key pattern: the rounding bottom. This chart shape looks like a “U” or bowl. It forms when prices drop, level out, then climb back up.

Traders love this pattern. Why? It often signals a shift from a bear market to a bull market. 8

The rounding bottom can take weeks or months to form. Patience pays off here. Smart traders watch for increased volume as prices rise. This confirms the pattern’s strength. Once prices break above the pattern’s high point, it’s go time.

Many jump in to ride the upward trend. But keep in mind – no pattern is perfect. Always use stop-loss orders to protect your cash. 1

Cup and Handle

The cup and handle pattern is a trader’s favorite. It’s like finding a hidden gem on a price chart. Imagine a smooth U-shaped dip (the cup) followed by a small downward drift (the handle).

This setup often hints at a bullish move ahead. Traders dig it because it’s easy to spot and can lead to sweet profits. 9

I’ve used this pattern myself with good results. It works best in uptrends and can take weeks or months to form. The key is patience. Wait for the handle to form and prices to break above it before jumping in.

Keep in mind, no pattern is perfect. Always use stop losses and manage your risk. With practice, you’ll improve at spotting these golden opportunities. 10

Wedges

Moving on from cup and handle patterns, let’s talk about wedges. These chart patterns pack a punch for traders. Wedges form when price moves tighten between sloping trend lines. 3 They come in two flavors – rising and falling.

Rising wedges spell trouble. They hint at potential price drops ahead. Falling wedges, on the other hand, suggest good times. They point to possible price climbs on the horizon. 2 Smart traders keep an eye out for these patterns.

They use wedges to time their moves and boost profits. It’s all about spotting the signs and acting fast.

Pennants and Flags

Flags and pennants are like brief pauses in a stock’s movement. They appear after a price increase, giving traders a moment to regroup. Imagine a flagpole (the price increase) with a small flag or pennant at the top – that’s your pattern! Flags tilt against the trend, while pennants narrow to a point.

Both indicate a short pause before the price potentially continues its upward movement. 11

Flags and pennants are the market’s way of catching its breath.

These patterns don’t last long… usually just a few weeks at most. Savvy traders watch for them. They’re like nature’s hint that, “Something significant might occur soon.” 12 But keep in mind, no pattern is foolproof.

Always use other indicators to confirm what you observe. It’s all about being smart and cautious in the trading world.

Ascending, Descending, and Symmetrical Triangles

Moving from pennants and flags, let’s explore another set of powerful chart patterns. Triangles are key tools in a trader’s kit. They come in three main types: ascending, descending, and symmetrical.

Ascending triangles spell good news for bulls. They show an uptrend is likely to keep going. You’ll spot them by a flat top line and a rising bottom line. 1 Descending triangles, on the flip side, hint at more downward movement.

They’re the opposite – a flat bottom with a falling top line. Symmetrical triangles? They’re the wild card. These patterns can break either way, up or down. Smart traders look at the trend before the triangle to guess which way it might go.

Keep an eye on these shapes – they can help you make smarter trades and boost your profits. 13

Candlestick Patterns for Trading

Candlestick patterns pack a punch in trading. They’re like secret codes on your charts. Wanna crack ’em? Keep reading!

Overview of Candlestick Patterns

Candlestick patterns pack a punch in trading. These visual tools show price moves using open, high, low, and close data. 14 Traders love them for quick market mood checks. 15 They’re like tiny stories of buyer-seller battles, all in one neat package.

Candlesticks are the trader’s crystal ball, revealing market sentiment at a glance.

While bullish patterns hint at price jumps, bearish candlestick patterns explained by analysts often indicate possible drops in price. 14 But it’s not just about looks. Smart traders mix these with other signs for better calls.

It’s like solving a puzzle – each piece matters. The key? Practice spotting these patterns to boost your trading game.

Key Candlestick Patterns

Now that we’ve covered the basics, let’s dive into the key candlestick patterns. These shapes can tell us a lot about market mood and potential price moves. 14

- Hammer: This pattern looks like a hammer with a small body and long lower shadow. It often signals a bullish reversal after a downtrend. 16

- Bullish Engulfing: A large green candle that fully engulfs the previous red candle. This pattern suggests buyers are taking control.

- Evening Star: A three-candle pattern with a tall green candle, a small-bodied candle, and a red candle. It hints at a bearish reversal.

- Bearish Engulfing: The opposite of bullish engulfing. A red candle swallows up the previous green one, showing sellers are gaining power.

- Doji: This candle has a tiny body with long shadows. It shows indecision in the market and might signal a trend change.

- Shooting Star: Looks like an inverted hammer with a small body and long upper shadow. It often pops up at the end of an uptrend.

- Hanging Man: Similar to the hammer but appears in an uptrend. It can warn of a potential bearish reversal.

- Harami: A two-candle pattern where a small candle is contained within the previous larger candle. It might indicate a slowdown in the current trend.

Advanced Trading Patterns

Advanced trading patterns pack a punch. They’re like secret weapons for savvy traders. Wanna learn more? Keep reading – you’ll be glad you did!

Triangle Patterns

Triangle patterns are like a pause button for stock trends. They show up when buyers and sellers are in a tug-of-war. These patterns come in three flavors: ascending, descending, and symmetrical.

Each type hints at where prices might go next. 17

Ascending triangles have a flat top and rising bottom. They often signal an upward breakout. Descending triangles? The opposite. They have a flat bottom and falling top, hinting at a downward move.

Symmetrical triangles are the wild cards. Their converging lines could lead to a breakout in either direction. Traders watch these shapes closely to spot potential profit opportunities. 2

The Double Bottom Pattern (W Pattern)

The Double Bottom Pattern resembles a “W” on stock charts. It’s a positive sign that appears when a stock reaches a low point twice. This pattern indicates the stock can’t fall further, which is encouraging for buyers.

I’ve watched this pattern work well in my own trades. It’s similar to seeing a boxer get knocked down twice but still rise – that’s when you know they’ve got fight left in them.

Traders appreciate this pattern because it suggests a possible upturn. The stock rebounds from support twice, showing it’s difficult to push lower. 18 It’s not guaranteed, but it’s a good indicator.

In my experience, pairing this with other signals – like increased trading volume – can improve your odds of identifying a winner. 19 Just keep in mind, no pattern is flawless, so always manage your risk.

Golden Cross Chart Patterns

Golden Cross chart patterns pack a punch in trading. They pop up when a short-term moving average jumps over a long-term one. Typically, we’re talking about the 50-day and 200-day averages. 20 But here’s the kicker – high trading volumes make these crosses even more potent. It’s like the market’s giving a thumbs up to the bullish trend.

Now, don’t confuse this with its evil twin, the Death Cross. While the Golden Cross hints at a bull market, the Death Cross… well, it’s not great news for the bulls. 21 It signals a long-term bear market might be lurking around the corner.

Smart traders keep an eye on both – it’s all part of that trading psychology game. Knowing these patterns can help you spot potential profit opportunities or avoid nasty surprises.

Bear Trap Chart Patterns

Bear traps in trading can fool even experienced investors. These tricky patterns appear when an asset’s price falls below a key support level. 23 Traders hurry to sell short, expecting the price to continue dropping.

But – plot twist! The price rebounds quickly, putting short sellers in a tough position. They rush to buy back shares at higher prices, often taking significant losses. It’s like fishing…

the bait seems appealing, but bam! You’re the one caught instead.

GameStop’s roller coaster in 2021 is a prime example of a bear trap. Short sellers wagered heavily against the stock, but it skyrocketed instead. 22 Many lost millions as they scrambled to cover their positions.

This highlights why savvy traders always use stop orders and careful risk management. Bear traps are sneaky, but identifying them can lead to substantial profits if you play your cards right.

Just keep in mind – the market can be a dangerous place if you’re not cautious!

Analyze and Apply Trading Patterns

Ready to level up your trading game? Let’s dive into the nuts and bolts of chart analysis. You’ll learn to spot key patterns that can boost your profits – and dodge costly mistakes.

Identify Trends, Support, and Resistance

Spotting trends, support, and resistance is key to make money with trading. These elements form the backbone of successful market analysis. Here’s how to identify them:

- Look for consistent price movements. Uptrends show higher highs and lows, while downtrends display lower highs and lows.

- Find support levels where prices stop falling. These act like a floor, catching falling prices. 24

- Spot resistance levels where prices halt their rise. Think of these as ceilings that block upward movement.

- Use moving averages to confirm trends. Prices above a moving average suggest an uptrend, while those below hint at a downtrend.

- Watch for breakouts. When prices push through support or resistance, it often signals a new trend.

- Check trading volume. Higher volume often backs up trend strength and breakouts.

- Apply the relative strength index (RSI). This tool helps spot overbought or oversold conditions.

- Look for chart patterns. Shapes like head and shoulders or double bottoms can signal trend changes. 3

- Pay attention to price action. Candlestick patterns offer clues about short-term sentiment shifts.

- Use multiple timeframes. Combining daily and weekly charts can give a fuller picture of market trends.

Reversals and Breakout Patterns

Reversals and breakout patterns are key tools for traders. They help spot trend changes and potential profit opportunities. 25

- Reversal patterns signal a shift in price direction:

- Head and shoulders: Looks like a peak with two smaller peaks on each side

- Double top/bottom: Forms an “M” or “W” shape on charts

- Rounding bottom: Shows a gradual change from bearish to bullish trend

- Breakout patterns hint at big price moves:

- Triangle: Price narrows into a point before breaking out

- Flag: Short pause in a strong trend, looks like a flag on a pole

- Cup and handle: Shaped like a tea cup, signals bullish continuation

- Volume confirms pattern strength:

- Higher volume on breakouts suggests more conviction

- Low volume can mean the pattern might fail

- Support and resistance levels matter:

- Breakouts above resistance or below support are key

- Failed breakouts often lead to sharp moves in the opposite direction

- Time frames affect pattern reliability:

- Longer-term charts (daily, weekly) tend to be more reliable

- Shorter time frames have more false signals

- Risk management is crucial:

- Set stop-loss orders to limit potential losses

- Don’t bet too big on any single pattern

Traders often use these patterns with other technical indicators for better results. Let’s explore how to combine volume and moving averages with price analysis. 2

Combine Volume and Moving Averages with Price Analysis

Combining volume, moving averages, and price analysis can supercharge your trading game. Let’s dive into some key ways to blend these powerful tools for better results.

- Watch volume spikes: Big jumps in trading volume often signal major market moves. When you see a surge in volume along with a price breakout, it’s a strong buy or sell signal. 27

- Use moving averages as support/resistance: The 50-day and 200-day moving averages act like floors or ceilings for stock prices. When prices bounce off these lines, it’s a good time to enter or exit trades.

- Look for crossovers: When a short-term moving average crosses above a long-term one, it’s called a “golden cross” – a bullish sign. The reverse, a “death cross,” suggests a downtrend.

- Check volume on breakouts: A price breakout with high volume is more likely to stick. Low volume breakouts often fizzle out quickly.

- Use moving average convergence divergence (MACD): This tool combines two moving averages to spot trend changes early. It’s great for timing entries and exits.

- Spot divergences: If the price is going up, but volume is dropping, it might mean the uptrend is weak. This divergence can warn you of a coming reversal.

- Combine with candlestick patterns: When you see a strong candlestick pattern at a key moving average level with high volume, it’s often a powerful trade setup. 26

- Use volume-weighted average price (VWAP): This tool shows the average price based on both volume and price. It’s super useful for day trading and gauging overall market sentiment.

People Also Ask

What are trading patterns, and why should I care?

Trading patterns are like road signs for the stock market. They show up on candlestick charts and help day traders spot trends. These patterns, born from supply and demand, can boost your profits if you know how to read them. It’s like being a mountain man in the wild – you’ve got to know the lay of the land to survive.

How can I use technical analysis to improve my trading strategy?

Technical analysis is your secret weapon. It’s not just looking at squiggly lines. You’re diving into market psychology and price action. Use tools like Bollinger Bands or the ADX indicator to spot buy and sell signals. It’s like having x-ray vision for the stock market.

What’s the deal with CFDs, and how do they fit into trading patterns?

CFDs, or Contracts for Difference, are like the wild west of trading. They let you bet on price movements without owning the asset. When you spot a pattern, you can use CFDs to ride the wave up or down. But watch out – it’s a double-edged sword with high risks and rewards.

Can I use trading patterns for short selling?

You bet! When you spot a double top pattern or bearish wedge, it might be time to short. It’s like predicting a storm – you’re betting on a downturn. Just remember, shorting comes with its own set of risks. Don’t get caught with your pants down when the market turns.

How do automated trading systems use these patterns?

Automated trading systems are like robot traders. They use algorithms to spot patterns and make trades faster than you can blink. These systems can analyze tons of data, looking for wedge patterns or other signals. But don’t think they’re foolproof – market structure can change in a heartbeat.

Are there any risks in relying too heavily on trading patterns?

You bet your bottom dollar there are! Relying solely on patterns is like putting all your eggs in one basket. Markets can be as unpredictable as a bucking bronco. Price manipulation, slippage, and liquidity issues can throw a wrench in the works. Always use patterns with other tools and keep your wits about you.

References

^ https://www.ig.com/en/trading-strategies/10-chart-patterns-every-trader-needs-to-know-190514

^ https://www.forex.com/en/learn-trading/11-chart-patterns-you-should-know/

^ https://www.cmcmarkets.com/en/trading-guides/stock-chart-patterns

^ https://www.investopedia.com/articles/technical/121201.asp

^ https://www.investopedia.com/terms/h/head-shoulders.asp

^ https://www.investopedia.com/terms/d/doubletop.asp

^ https://www.babypips.com/learn/forex/double-top-and-double-bottom

^ https://www.strike.money/technical-analysis/chart-patterns

^ https://trendspider.com/learning-center/chart-patterns-cup-and-handle/

^ https://www.investopedia.com/terms/c/cupandhandle.asp

^ https://www.investopedia.com/terms/p/pennant.asp (2023-12-10)

^ https://stockstotrade.com/flags-and-pennants/ (2024-06-27)

^ https://trendspider.com/learning-center/chart-patterns-ascending-and-descending-triangles/

^ https://www.morpher.com/blog/candlestick-patterns (2024-01-22)

^ https://www.investopedia.com/articles/active-trading/092315/5-most-powerful-candlestick-patterns.asp

^ https://www.babypips.com/trading/top-7-candlestick-patterns-to-use-in-trading-forex-and-crypto

^ https://www.investopedia.com/terms/t/triangle.asp

^ https://www.thinkmarkets.com/en/trading-academy/indicators-and-patterns/double-bottom-pattern/ (2023-12-18)

^ https://www.strike.money/technical-analysis/double-bottom-pattern (2024-02-28)

^ https://www.investopedia.com/terms/g/goldencross.asp

^ https://www.litefinance.org/blog/for-professionals/100-most-efficient-forex-chart-patterns/golden-cross-pattern/ (2023-04-21)

^ https://www.investopedia.com/terms/b/beartrap.asp

^ https://www.litefinance.org/blog/for-professionals/100-most-efficient-forex-chart-patterns/what-is-a-bear-trap/ (2022-11-11)

^ https://www.investopedia.com/trading/support-and-resistance-basics/

^ https://optionstrategiesinsider.com/blog/17-stock-chart-patterns-to-look-for-when-analyzing-stocks/

^ https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8345893/

^ https://www.investopedia.com/top-7-technical-analysis-tools-4773275