Ever felt lost in the maze of modern banking? You’re not alone. Online banking now serves over 2 billion people worldwide. This post will show you seven game-changing features that’ll make your financial life easier.

What is online banking? Let’s find out!

Key Takeaways

Online banking lets you handle money tasks from your phone or computer, serving over 2 billion people worldwide.

Key features include 24/7 account access, remote check deposits, easy transfers between accounts, and cardless ATM withdrawals.

Online banks often have lower fees and higher interest rates than traditional banks, but only 6% of U.S. adults with bank accounts use online-only banks.

Strong security measures like encryption and two-factor authentication help protect your money online.

Potential challenges include technical issues, less personal interaction, and the need to stay alert for phishing scams and other security risks.

Table of Contents

Understanding Online Banking

Online banking is like having a bank in your pocket. It lets you handle money stuff without going to a branch. You can check your balance, pay bills, and move cash around – all from your phone or computer.

It’s super handy! Almost every bank now offers this service. You just need internet access and a device to get started. Guys, think about it – no more waiting in lines or rushing to the bank before it closes.

Sweet, right?

Here’s the cool part: online banks often give you better deals. They have lower fees and higher interest rates than old-school banks. That’s because they don’t have to pay for fancy buildings.

But get this – only 6% of U.S. adults with bank accounts use online-only banks. Crazy, huh? If you want to learn more about what is online banking, there’s tons of info out there.

Just be sure to keep your info safe when banking online. Use strong passwords and be careful with suspicious emails.

The Mechanics of Online Banking

Online banking is like having a bank in your pocket. It’s a digital playground where you can move money, pay bills, and check your balance – all with a few taps on your phone or clicks on your computer.

Accessing Accounts Through Browsers and Apps

Guys, let’s talk about getting into your bank accounts online. It’s super easy these days. You can use your computer’s web browser or grab your phone and open a banking app. Both ways let you check your balance, move money around, and pay bills.

No need to drive to the bank or wait in line. Just log in with your username and password, and boom – you’re in! But here’s the thing: make sure you’re using a secure Wi-Fi network.

Public hotspots can be risky for banking.

Now, about those apps… They’re pretty slick. Most banks have their own apps you can download for free. They’re usually faster than using a browser and come with cool features like fingerprint login or face recognition.

Plus, you can set up alerts to ping you when money goes in or out of your account. It’s like having a mini bank in your pocket. Next up, we’ll chat about how you can deposit checks without leaving your couch.

Remote Deposits of Checks

Remote check deposits are a game-changer. No more trips to the bank or ATM! Just snap a photo of your check with your phone’s banking app. It’s that easy. You’ll enter the amount, hit submit, and boom – money in your account.

Remote check deposits are a game-changer. No more trips to the bank or ATM! Just snap a photo of your check with your phone’s banking app. It’s that easy. You’ll enter the amount, hit submit, and boom – money in your account.

This tech is a real time-saver. You can deposit checks from anywhere, anytime. At home in your PJs? On a lunch break? No problem. The app does all the heavy lifting. It’s like having a mini bank teller right in your pocket.

Remote deposit capture is like having a 24/7 bank branch in your smartphone.

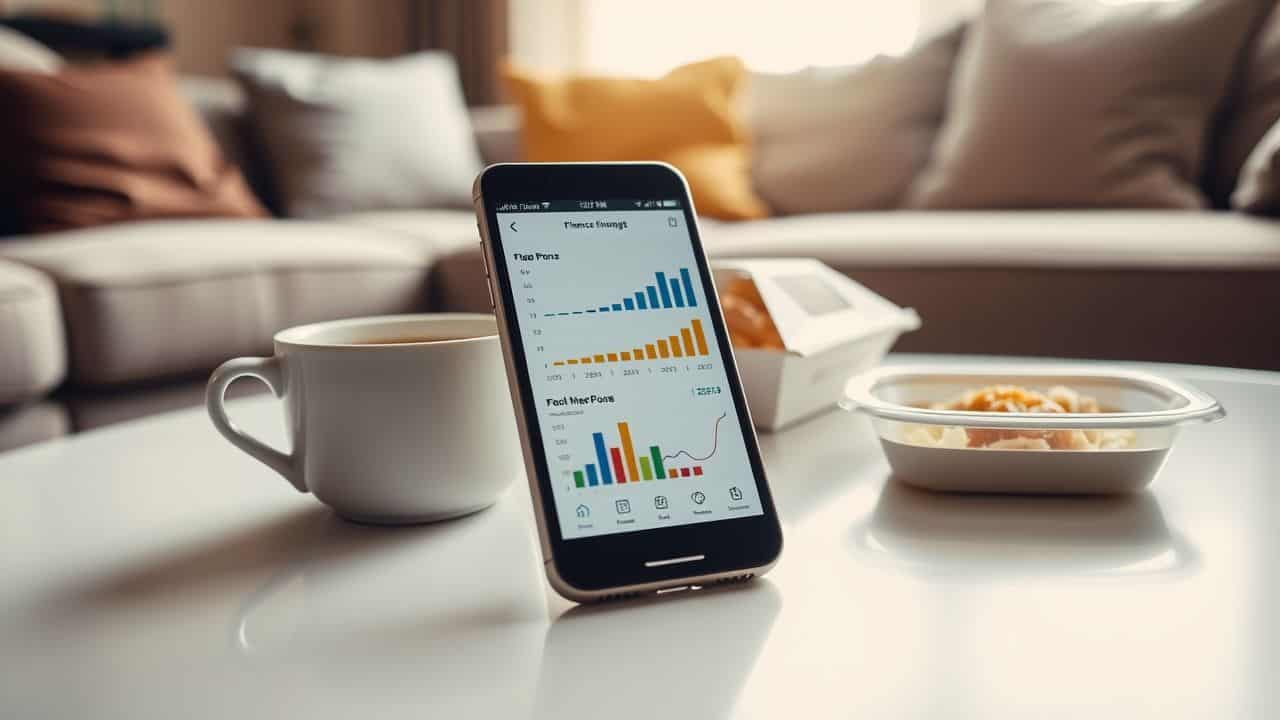

Finance Management and Budgeting Tips

Online banks offer cool tools to help you manage your money. You can track where your cash goes and set goals for saving. It’s like having a personal money coach in your pocket! These apps make it easy to see your spending habits.

You might be surprised how much you spend on coffee or takeout.

Setting up auto-transfers to savings is a game-changer. It’s like paying yourself first, before you can spend it all. This trick helps build your nest egg without even thinking about it.

Plus, you can use the app to check your progress anytime. Next up, let’s look at how easy it is to move money between accounts.

Account-to-Account Transfers

Moving money between banks is a breeze these days. You can zap cash from your checking to savings in seconds. No more paper checks or long waits. Just tap a few buttons on your phone, and voila! Your funds are where you want ’em.

But here’s the kicker – fees can sneak up on you. Wire transfers? They’ll set you back about $26 a pop. Ouch! Good news though… apps like PayPal or Venmo often cost zilch. And email transfers? Usually free and instant.

It’s like magic for your wallet. Just pick the method that works best for you and your budget.

Monitor and Order Checks

Online banking lets you keep tabs on your checks and order new ones with ease. No more trips to the bank! Just log into your account and boom – you can see your check status in a snap.

Need more checks? No sweat. Pick from a full catalog right on your screen. Want to jazz them up? Go wild with custom fonts, pics, or text. It’s like designing your own mini billboards…

but for your money.

I’ve used this feature tons of times. It’s a lifesaver when you’re running low on checks. One time, I was down to my last check and had rent due. I hopped on my bank’s app, ordered new ones, and they arrived just in time.

The whole process took maybe five minutes. It’s way faster than the old days of filling out paper forms and waiting forever. Plus, you can track your order right from your phone. No more wondering when those checks will show up in your mailbox.

Advantages of Online Banking

Online banking is a game-changer. It’s like having a bank in your pocket – always open, always ready.

The Convenience of 24/7 Access

Online banking puts your money at your fingertips 24/7. No more rushing to the bank before it closes or waiting for business hours. You can check your balance, pay bills, or move funds anytime – even at 3 AM in your pajamas.

It’s like having a personal banker in your pocket, ready to help whenever you need it.

This round-the-clock access isn’t just handy – it’s a game-changer. Late-night shopping spree? Check your balance first. Forgot to pay rent? No problem, schedule it right away. With online banking, you’re always in control of your cash.

Online banking is like having a 24-hour ATM in your living room.

It’s perfect for busy guys who don’t have time to visit a branch during the day.

Saving on Costs and Fees

Moving from 24/7 access to saving money, online banking shines. It’s a real game-changer for your wallet. Most web banks don’t charge fees for basic services. You can pay bills, transfer cash, and check your balance for free.

This beats traditional banks that often hit you with monthly fees.

But it gets better. Online banks tend to offer higher interest rates on savings accounts compared to cryptocurrency. I’ve seen rates up to 2% higher than brick-and-mortar banks.

That means more money in your pocket over time. Plus, you’ll save on gas and time by not driving to a physical bank. It’s a win-win for your finances and schedule.

Speed of Transactions

Online banking zips through transactions at lightning speed. Gone are the days of waiting for checks to clear or standing in line at the bank. Now, you can move money between accounts in seconds.

Pay bills with a few clicks. Even send cash to friends instantly. This speed isn’t just convenient – it’s a game-changer for managing your finances.

But speed isn’t the only perk. Online banking also cuts down on errors. No more messy handwriting or lost paper trails. Everything’s digital, tracked, and easy to review. Plus, you can set up alerts to catch any weird activity fast.

It’s like having a financial superhero in your pocket, ready to swoop in 24/7.

Enhanced Security Features

Banks take your money’s safety seriously. They use top-notch security to guard your cash online. Encryption keeps your data safe from prying eyes. It’s like a secret code that only you and your bank can crack.

Two-factor authentication adds an extra layer of protection. It’s like having a bouncer at the door of your account. You need more than just a password to get in.

My bank’s security is tighter than Fort Knox. I feel safer than a squirrel with a lifetime supply of nuts!

Most banks now use smart tech to spot fishy activity. They watch your account 24/7 for weird transactions. If something looks off, they’ll let you know fast. Some even use fancy AI to predict and stop fraud before it happens.

It’s like having a personal bodyguard for your money. Pretty cool, right?

Essential Services Offered by Online Banks

Online banks pack a punch with their services. They’ve got tools that’ll make your life easier – from paying bills to grabbing cash without a card.

Paying Bills Online

Paying bills online is a game-changer. No more stamps, envelopes, or trips to the post office. Just a few clicks, and you’re done. It’s fast, easy, and saves you time. Plus, you can set up auto-pay for regular bills.

This means no more late fees or forgotten payments.

Online bill pay also gives you a clear record of your spending. You can see all your payments in one place. This makes budgeting a breeze. Many banks even offer tools to help you track your money.

With these perks, it’s no wonder more guys are switching to digital payments. Next up, let’s talk about moving money between accounts.

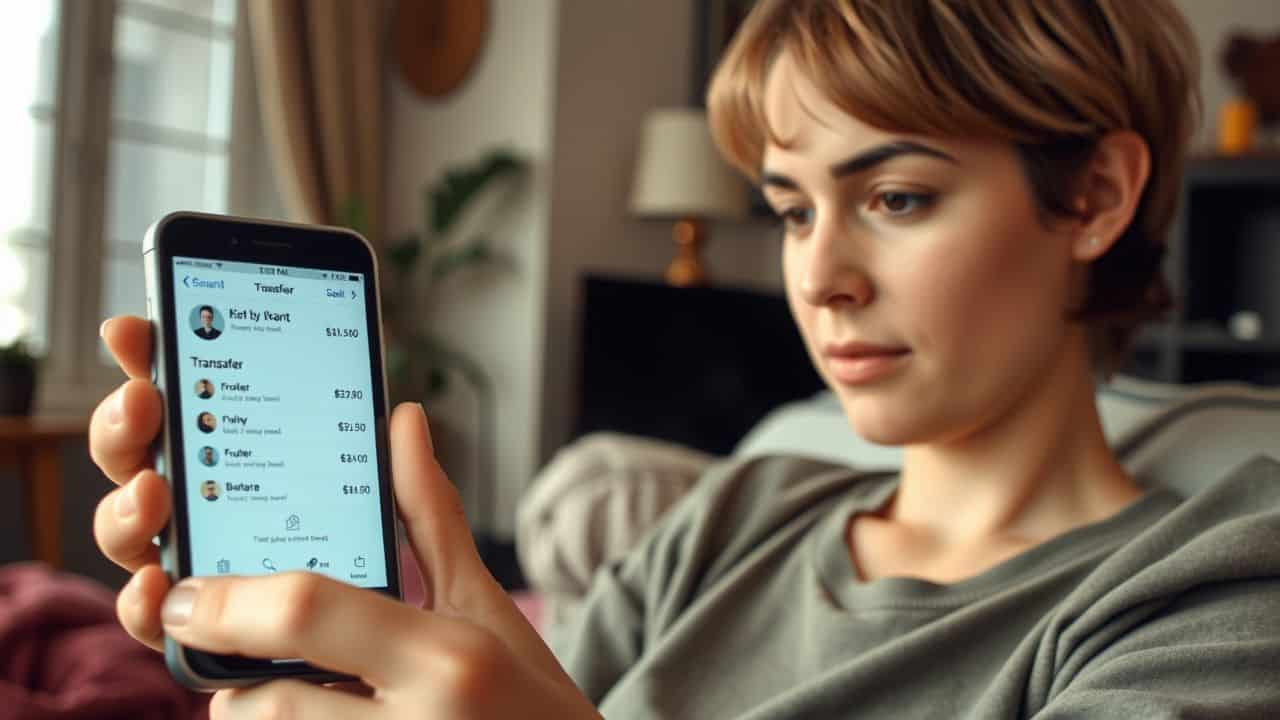

Transferring Funds Between Accounts

Moving money between accounts is a breeze with online banking. You’ve got options, guys. Wire transfers are quick but can cost you about $26 for domestic moves. That’s a bit steep.

But don’t sweat it – there are cheaper ways. Apps like PayPal or Venmo let you zip cash around for less. They’re fast and easy to use, too.

Want to shift funds between different banks? External transfers have got you covered. It’s simple and handy. No need to leave your couch or put on pants. Just log in, pick the accounts, enter the amount, and boom – money moved.

It’s like magic, but better… because it’s real cash. And it’s all thanks to the wonders of internet banking. Pretty sweet, right?

Using Cardless ATM Withdrawals

Cardless ATMs are changing the game. No more fumbling for your wallet or card at the machine. Now, you can grab cash with just your phone. It’s simple: use your bank’s app or a mobile wallet to set up the withdrawal.

Then, scan a QR code or tap your phone at the ATM. Some even use face or finger scans to check it’s really you. It’s quick, easy, and you don’t need to touch as many surfaces.

This tech isn’t just cool – it’s safer, too. Crooks can’t steal your card info if you don’t use one. Plus, it’s great when you forget your wallet but need cash fast. More banks are jumping on board, so keep an eye out for this option at ATMs near you.

Next up, let’s talk about how online banks keep your money safe.

Instant Approvals for Online Applications

Instant approvals for online applications make opening bank accounts a breeze. No more waiting in line or filling out stacks of papers. You can start your new account in minutes, right from your couch.

Many online banks offer this quick setup process. They’ve streamlined things to get you banking faster.

Got your ID and basic info ready? That’s all you need. The bank’s system checks your details in real-time. If all looks good, you’re approved on the spot. Some accounts don’t even need money to start.

No minimum balance? No problem. It’s banking made simple for busy folks like you.

Safeguarding Your Online Banking Experience

Keeping your money safe online is a big deal. Want to learn some cool tricks to protect your cash? Read on!

Implementing Strong Passwords and Two-Factor Authentication

Strong passwords are your first line of defense in online banking. Mix up letters, numbers, and symbols to create a tough code. Don’t use easy stuff like “password123” or your birthday.

Instead, try something like “B@nk1ng_R0cks!” Two-factor authentication adds an extra layer of security. It’s like having a security guard at a club who checks your ID and searches you.

With 2FA, you need your password plus another piece of info to log in. This could be a code sent to your phone or a fingerprint scan. It’s a simple step that makes it much harder for bad guys to break into your account.

Using public Wi-Fi for banking is a big no-no. It’s like shouting your bank info in a crowded room. Stick to secure networks at home or use your phone’s data plan. Keep in mind, your bank will never ask for your password via email or text.

If you get a message like that, it’s probably a scam. Stay alert and keep your banking info close to your chest. With these tips, you’ll be great at keeping your money safe online.

Regular Account Monitoring

Keep an eye on your money! It’s smart to check your bank account often. This helps you spot any odd charges fast. Set up alerts on your phone for new transactions. You’ll know right away if someone tries to use your card without your okay.

It’s like having a guard dog for your cash.

Lots of folks only look at their accounts once a month. That’s not enough! Make it a habit to peek at your balance every few days. It’s quick and easy with mobile apps. Plus, you’ll sleep better knowing your hard-earned money is safe.

Next up, let’s talk about how to defend against sneaky scams that try to trick you online.

Defending Against Phishing Scams

Phishing scams are sneaky tricks that can steal your bank info. Bad guys send fake emails or texts that look real. They try to get you to click links or share passwords. Don’t fall for it! Check sender addresses closely.

Hover over links to see where they really go. Never click stuff you’re not sure about. I once almost fell for a phishing email that looked just like my bank’s. But the web address was slightly off.

Close call! Stay sharp out there, fellas.

Next up, we’ll look at some bumps in the road with online banking. No system’s perfect, right?

Potential Challenges in Online Banking

Online banking isn’t always smooth sailing. It’s got its fair share of hiccups – from tech glitches to cyber threats.

Handling Technical Issues and Downtime

Technical hiccups in online banking can be a real pain. Your bank’s website might crash or slow down when you need it most. It’s frustrating, but don’t worry – your money is safe.

Banks know these issues cost big bucks. They lose about $1.55 million each year due to tech problems. That’s why they work hard to fix things fast.

Sometimes, banks plan downtime for updates. They’ll usually let you know ahead of time. But surprise outages happen too. It’s smart to have a backup plan. Keep some cash on hand or have another way to pay bills.

Next up, we’ll look at how online banking can feel less personal than visiting a branch.

Coping with Limited Personal Interaction

Online banks lack face-to-face chats. This can be tough when you need help fast. You might miss the friendly teller who knows your name. But don’t worry! Many web banks offer great phone and chat support.

They’re quick to answer and solve problems. Some even have video calls to make it feel more personal.

Still, complex issues can take longer to fix without in-person talks. It’s harder to explain tricky money matters over the phone or email. But online banks are getting better at this.

They’re using smart tech to understand and fix problems faster. Plus, you save time by not having to visit a branch. It’s a trade-off between ease and that personal touch.

Mitigating Security Risks and Data Breaches

While personal banking has its perks, keeping your money safe online is crucial. Let’s talk about how to protect your cash from cyber crooks. It’s not rocket science, but it does take some smarts.

First off, use strong passwords – mix it up with letters, numbers, and symbols. Two-factor authentication is your friend… it’s like having a bouncer for your bank account. Keep an eye on your statements, too.

If something looks fishy, speak up fast. Watch out for fake emails trying to steal your info. Banks won’t ask for your password via email – that’s a red flag. Stay sharp, fellas.

Your money’s worth the extra effort to keep it safe.

People Also Ask

What’s the big deal about online banking?

Online banking is like having a bank in your pocket. It lets you handle money stuff on the internet. You can check your account balances, pay bills, and move cash around. No need to visit a branch or wait in line. It’s open 24/7, so you can bank in your PJs if you want!

How safe is web banking?

Banks take cybersecurity seriously. They use fancy tech like multifactor authentication to keep your money safe. But you’ve got to do your part too. Use strong passwords, avoid public Wi-Fi, and keep an eye out for fishy emails. It’s like locking your front door – basic safety goes a long way.

What cool features can I expect with virtual banking?

Virtual banking is packed with nifty tools. You can deposit checks by snapping a photo, set up automatic bill payments, and even apply for loans online. Some banks offer budgeting tools and predictive analysis to help you manage your cash better. It’s like having a personal financial wizard at your fingertips!

Can I use online banking on my phone?

You bet! Mobile banking apps let you do almost everything on your smartphone or tablet. Check your balance, transfer money, or even send cash to friends using services like Zelle. Some apps even work with smartwatches. It’s banking that moves as fast as you do.

What’s the deal with digital wallets like Apple Pay and Google Pay?

Digital wallets are the cool kids of the payment world. They store your credit card info securely on your phone. You can pay in stores or online with a tap or click. No need to fumble for your wallet. It’s like having a magic wand for payments!

How do I protect myself from online banking fraud?

Stay sharp! Use strong, unique passwords for each account. Enable two-factor authentication when possible. Keep your software updated to guard against malware. Watch out for phishing emails or fake websites trying to steal your info. If something looks fishy, trust your gut. It’s better to be safe than sorry when it comes to your hard-earned cash!

References

https://www.investopedia.com/terms/o/onlinebanking.asp

https://www.bankofamerica.com/onlinebanking/education/features-of-online-banking.go

https://www.mymechanics.com/personal/banking/online-and-mobile-banking-with-bill-pay/

https://www.visionfactory.org/post/the-benefits-of-online-banking-convenience-security-and-more

https://www.synchrony.com/blog/banking/online-banking-benefits

https://www.chime.com/blog/features-and-advantages-of-online-banking/ (2023-06-30)

https://www.fool.com/money/banks/articles/these-7-online-banking-features-are-must-haves/

https://www.bankrate.com/banking/how-to-transfer-money-from-one-bank-to-another/ (2024-06-20)

https://www.capitalone.com/learn-grow/money-management/what-is-a-cardless-atm/

https://www.forbes.com/advisor/banking/how-to-protect-your-online-banking-information/ (2023-04-19)

https://www.fool.com/money/banks/articles/online-banking-safety-tips-you-should-know/ (2021-07-17)

https://www.aura.com/learn/online-banking-security (2024-02-21)

https://www.pathwaybank.com/top-7-fraud-prevention-tips-for-online-banking

https://blog.inboundfintech.com/5-issues-and-challenges-in-the-online-banking-sector (2021-10-29)

https://www.payoneer.com/resources/online-banking/

https://levelblue.com/blogs/security-essentials/the-importance-of-cybersecurity-in-online-banking (2024-02-22)