Dreaming about owning a vacation home but can’t afford the full price? You’re not alone. The timeshare industry will hit $17.3 billion in 2023, as more people look for smart ways to enjoy yearly getaways.

I’ll show you exactly how does a timeshare work, from costs and contracts to the hidden truths about vacation ownership. Ready to learn if a timeshare is right for your wallet?

Key Takeaways

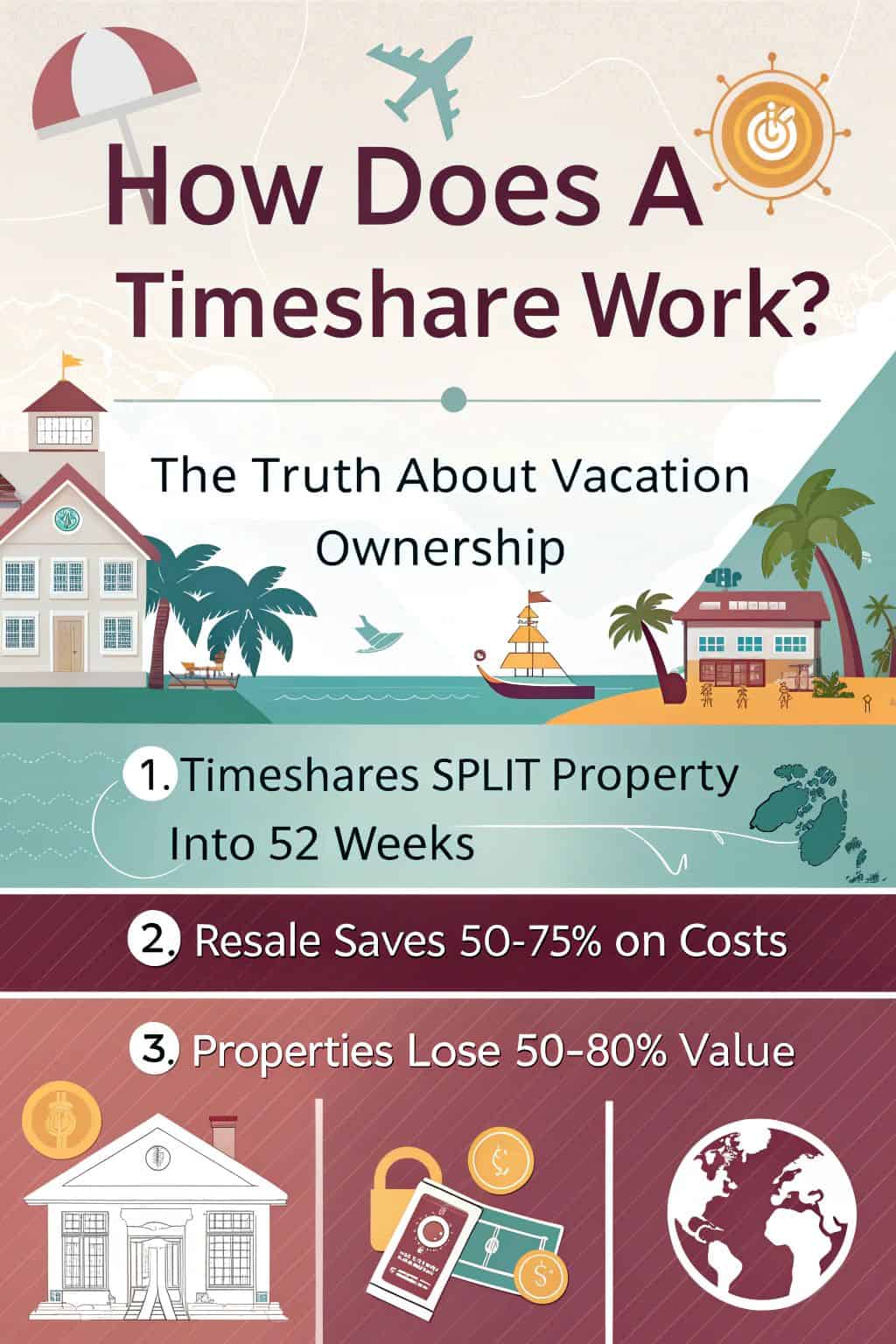

Timeshares split vacation property among 52 owners, with average upfront costs of $24,140 and yearly maintenance fees of $1,120.

Three main types exist: fixed weeks (same time yearly), floating weeks (flexible dates within a season), and points systems for booking multiple resorts.

The timeshare industry will reach $17.3 billion in 2023, but properties lose 50-80% of their value after purchase, similar to new cars.

Resale purchases save 50-75% compared to buying directly from developers, with the current market offering 204,100 units for sale.

While timeshares include resort amenities and guaranteed vacation spots, they come with rising yearly fees and are hard to sell or exit from long-term contracts.

Table of Contents

What Is a Timeshare?

A timeshare lets you own a slice of vacation property with 51 other people. Think of it as buying your spot at a resort for one week each year. The concept started in 1969, and today’s average timeshare costs $24,140 upfront.

I bought my first timeshare five years ago and learned that these properties work like a pizza – you get your piece, but so do many others.

Most timeshares operate as deeded property or leased contracts at vacation spots. You’ll pay yearly maintenance fees around $1,120 to keep the place running smoothly. My experience taught me that if you want to cancel Sapphire resorts or other timeshare contracts, you should read the fine print carefully.

The value drops fast after purchase, just like a new car driving off the lot.

How Do Timeshares Work?

Timeshares split vacation property rights among multiple owners, each getting specific weeks or points to use the space. You’ll pick between shared deeded contracts that give you partial ownership forever, or shared leased agreements that let you use the property for a set number of years.

Shared Deeded Contracts

Shared deeded contracts give you real ownership of your vacation property. You’ll get a deed for a specific unit during your assigned time, just like owning a house. The property splits among up to 52 different owners, with each person getting their slice of paradise.

I bought my first deeded timeshare in Miami five years ago, and the process felt similar to buying my primary home. The contract has no end date, and I can pass it down to my kids or sell it whenever I want.

Your name goes on the property deed, making you responsible for yearly property taxes and maintenance fees. The legal paperwork stays in your name until you decide to transfer or sell it.

A deeded timeshare is like having a slice of your favorite pizza – it’s yours to keep, share, or pass on to others.

Most resort timeshares use this ownership model because it offers the strongest legal rights to buyers. My deed lets me rent out my week when I can’t use it, which helps offset some annual costs.

The fractional ownership structure means you split all property-related expenses with other owners, making luxury vacation spots more budget-friendly.

Shared Leased Contracts

Leased timeshare contracts give you the right to use a vacation spot for a set time. The resort keeps full ownership of the property, while you pay for access rights lasting 20 to 99 years.

Leased timeshare contracts give you the right to use a vacation spot for a set time. The resort keeps full ownership of the property, while you pay for access rights lasting 20 to 99 years.

Many guys pick this option because it costs less upfront than buying a deeded share. You’ll still need to budget for yearly maintenance fees and special assessments.

These deals often pack less value than deeded contracts in the resale market. I learned this firsthand when trying to sell my leased timeshare in Florida – the offers came in way below my purchase price.

The Federal Trade Commission warns buyers about this lower resale potential. Most banks won’t offer loans for leased timeshares either, so you’ll likely need cash or credit cards to buy in.

Types of Timeshares

Timeshares come in three main types, each with its own rules for usage and booking. You’ll need to pick between fixed weeks, floating schedules, or a points-based system that matches your vacation style.

Fixed Week Option

The fixed week option stands as the most basic form of timeshare ownership. You’ll own the right to use a specific unit during the same week every year. I bought my first fixed week at a Marriott resort in Florida, and it’s perfect for guys who love routine.

Your vacation spot stays locked in – same place, same time, year after year. This setup works great if you want to travel like a one-percenter without the full cost of owning a vacation home.

A fixed week timeshare is like having a standing reservation at your favorite steakhouse – you know exactly what you’re getting, when you’re getting it, and there’s no surprises.

The points system brings more choices, but fixed weeks keep things simple. Your deeded ownership means you can sell, rent, or pass it down to family members. Major brands like Wyndham and Holiday Inn Club offer these options with solid amenities.

The floating week system offers a different approach to vacation planning.

Floating Week Option

Floating week timeshares give owners more freedom in picking their vacation dates. You’ll get to book your stay within a specific season, like summer or winter. This setup works great for guys who can’t lock down exact vacation dates months ahead.

Your contract lets you grab any week that’s open in your season, but you’ll need to compete with other owners for prime spots.

Booking your floating week requires quick action and smart planning. Most resorts use a first-come, first-served system for reservations. Smart owners jump on peak times like holidays or school breaks early.

Supply and demand play a big role here – everyone wants those perfect beach weeks in July or prime ski dates in December. Points systems offer another way to make the most of your timeshare investment.

Points System

Modern timeshare systems have moved beyond fixed and floating weeks to offer points-based options. Points work like vacation currency at timeshare resorts. You’ll get a set number of points each year to book your stays.

The beauty lies in the freedom to split these points across multiple trips or save them for bigger vacations later.

Your points’ value changes based on where and when you want to stay. Peak seasons at popular resorts need more points than off-peak times. For example, a beach resort might require double the points during summer compared to winter.

The system lets you bank unused points for next year’s trips. You’ll pay extra fees for upgrades or last-minute bookings through exchange programs. Smart point management helps stretch your vacation dollars further.

Timeshare Costs

Timeshare costs go beyond the initial purchase price, with direct buys from developers costing more than resale options – plus yearly maintenance fees and exchange program charges that can add up fast.

Want to know the full-cost breakdown? Let’s dive into the details.

Direct Purchase

Buying a timeshare directly from a developer costs $22,000 on average. Most sales occur through presentations at resorts, where salespeople pressure you to sign up immediately. I’ve attended these pitches, and they offer free gifts as incentives to attend.

The sales team promotes luxury amenities and prime vacation spots, but rarely discusses the high annual maintenance fees exceeding $1,000.

Buy in haste, repent at leisure – this applies strongly to vacation ownership.

The real estate market indicates these properties depreciate faster than a car’s value after purchase. Direct purchases often include financing options through the developer, but interest rates exceed standard home loans.

Many buyers commit to the idea of yearly vacations without evaluating the long-term financial responsibility. The mortgage payments plus maintenance fees could cover several premium hotel stays each year instead.

Resale Purchase

Resale timeshares offer major savings compared to direct purchases from developers. Smart buyers grab these deals on the secondary market at 50-75% less than retail prices. The market now has 204,100 units up for grabs, which means plenty of options at bargain rates.

I picked up my own timeshare resale in Orlando for just $5,000 – the same unit sold new for $22,000 just two years earlier.

The resale process needs careful steps through the timeshare exchange program. First, check the resort’s rules about transfer fees and right of first refusal. Next, get a title search to spot any liens or problems.

Most resale deals close through escrow companies that handle the money and paperwork. The whole process took me about 60 days from offer to keys-in-hand. Pro tip: Ask the homeowners association about maintenance fee history before signing anything.

Annual Maintenance Fees

Maintenance fees hit your wallet hard each year as a timeshare owner. The average owner pays between $1,120 to $1,200 yearly for basic upkeep, repairs, and property management. I learned this the hard way with my first timeshare purchase back in 2018.

These fees keep climbing like a rocket – they jumped 12% from 2018 to 2021.

Your bank account takes a bigger hit every year since these fees typically rise about 2% annually. Money market experts predict these costs will reach $1,250 by 2024. The fees cover everything from keeping the pool clean to fixing broken air conditioners.

Many owners use a line of credit or personal loan to handle these growing expenses. Smart buyers check the fee history before signing any timeshare deed to avoid future budget surprises.

Exchange Program Fees

Beyond yearly upkeep costs, timeshare owners often pay fees to swap their vacation weeks. Exchange networks like RCI and Interval International charge yearly membership dues to access their services.

These fees let owners trade their timeshare weeks at different resorts worldwide.

Exchange programs turn your fixed vacation spot into a passport to global destinations

The swap fees typically range from $150 to $300 per exchange. Most networks require a base membership fee of $89 to $199 per year. This system gives owners more choices for their vacation spots.

Trading weeks through these networks adds value to timeshare ownership, but the extra costs need careful planning. The fees cover the service of matching available properties and handling the paperwork for each exchange.

What’s Included in Timeshare Costs?

A timeshare package goes beyond just giving you a place to crash during vacation. Your costs cover sweet perks like private pools, fitness centers, and special deals with partner resorts across the globe.

Accommodation Access

Timeshare ownership gives you a place to stay at top-notch resorts without hotel booking hassles. Your deeded contract lets you walk into fully-furnished rooms with kitchen spaces and living areas.

Most properties offer multi-bedroom units, perfect for bringing along family or friends. The rooms often match or beat standard hotel rooms in size and comfort level.

Resort stays through timeshare programs come with guaranteed space during your scheduled time. You’ll bypass the stress of finding last-minute vacation spots during peak seasons. Many properties sit right on beaches or near major attractions, saving you money on prime location stays.

Next up, let’s explore the resort amenities that make these properties worth considering.

Resort Amenities

Beyond basic lodging, modern resorts pack serious perks into their properties. Your stay includes full access to Olympic-sized swimming pools, state-of-the-art fitness centers, and premium sports courts.

I’ve spent countless hours enjoying these extras during my stays. The pools alone offer a perfect spot to unwind after a long day of activities.

Resort facilities go way beyond the standard hotel offerings. Most properties feature spacious common areas spanning over 1,000 square feet, complete with game rooms and BBQ spots.

My favorite amenity has always been the fully-equipped kitchen – it saves a ton of cash on dining out. The tennis courts, golf courses, and spa services add major value to the whole package.

These perks make shared ownership feel more like having your own private club membership.

Exchange Network Memberships

Timeshare exchange networks open doors to global travel options. Major players like RCI and Interval International give members access to over 7,000 resorts worldwide. These networks turn your fixed vacation spot into a ticket to explore new destinations.

You’ll need to pay yearly membership fees to join these clubs, but the travel choices make it worth it.

The exchange system works like a swap meet for vacation spots. Your timeshare acts as trading currency in these networks. Members can trade their week at their home resort for time at different properties across the globe.

Most networks rate properties based on location, amenities, and season to keep trades fair. Smart travelers use these memberships to stretch their vacation dollars and visit bucket-list destinations.

Pros and Cons of Timeshares

Let’s explore the bright spots and rough patches of timeshare ownership, from getting your own slice of paradise to dealing with yearly fees that might make your wallet sweat – read on to learn if this vacation style fits your travel dreams.

Pros

Timeshare ownership brings several clear benefits to vacation planning. Smart buyers often find great value in these properties, which offer over 1,000 square feet of living space on average.

- Fixed Vacation Schedule: You’ll have a guaranteed spot each year at your chosen resort. This makes planning easier and stops the mad rush to book hotels during peak seasons.

- Spacious Living Areas: Most timeshare units offer more room than standard hotel rooms. Your family gets separate bedrooms, full kitchens, and living spaces to spread out and relax.

- Resort-Style Amenities: Access pools, fitness centers, and other high-end features without extra costs. Many properties include tennis courts, golf courses, and spa services right on site.

- Cost Savings Over Time: Regular hotel stays in prime locations often cost more than annual timeshare fees. Your vacation costs become more predictable through fixed maintenance fees.

- Exchange Options: Trade your week for stays at other resorts worldwide. This flexibility lets you explore new places while keeping your home resort benefits.

- Property Upkeep Without Hassle: The resort handles all maintenance and repairs. No need to worry about yard work, repairs, or finding service providers.

- Social Connections: Many owners return the same week yearly, creating lasting friendships with other families. This builds a vacation community you’ll look forward to seeing.

- Quality Standards: Major hotel brands manage many timeshare properties. This means consistent, high-quality experiences every visit.

- Forced Vacation Time: Having pre-paid vacation time motivates you to actually take breaks. Studies show regular vacations improve work performance and health.

Guaranteed Vacation Time

Buying a timeshare means you’ll never miss another vacation. Your yearly getaway stays locked in, giving you peace of mind about future trips. Most contracts give owners fixed dates at specific resorts, much like having your own vacation home.

This setup works great for guys who like to plan ahead and want a reliable spot for their annual break.

A big plus of fractional usage is the promise of high-end resort stays every year. Your rental property comes with full amenities, just like a fancy hotel. Many owners love knowing they have a guaranteed spot during peak seasons, especially at popular beach or ski locations.

The deeded contracts make sure no one can take away your vacation time, even during busy holiday periods.

Access to High-Quality Resorts

Beyond guaranteed vacation time, timeshare properties offer stays at top-tier resorts. These properties stand out with their first-class amenities and upscale living spaces. I recently stayed at a timeshare resort in Florida that blew me away with its five-star features.

The property had three swimming pools, a golf course, and a private beach access.

Most timeshare resorts come packed with luxury touches you won’t find in regular hotels. Think full kitchens with granite countertops, in-unit washers and dryers, and spacious living areas.

The resort I visited had a master suite bigger than my first apartment. Plus, these properties often sit in prime locations – right on the beach or next to major attractions. You’ll get access to fitness centers, spa services, and on-site restaurants without extra fees.

It’s like owning a slice of a fancy vacation home without the full cost of buying one.

Cons

High-quality resorts offer great amenities, but timeshares come with serious drawbacks. Let’s look at the major problems you’ll face with timeshare ownership.

- Limited Booking Options: You’re stuck with specific weeks or points that might not match your schedule. Many owners struggle to book their preferred dates, especially during peak seasons.

- Rising Maintenance Fees: The average annual fee hits $1,000 and keeps climbing. These fees must be paid whether you use the property or not, just like a mortgage payment.

- Difficult to Sell: The resale market is flooded with timeshares. Most units sell for pennies on the dollar compared to their original purchase price.

- Long-term Contract Lock-in: Most timeshare agreements last decades. Breaking free from these contracts often requires legal help or professional exit services.

- Poor Investment Value: Unlike regular real estate, timeshares typically lose value fast. They rarely build equity like a traditional property investment would.

- Extra Hidden Costs: Special assessments, exchange fees, and property taxes add up quickly. These costs often surprise owners who didn’t read the fine print.

- Hard to Finance: Banks rarely offer loans for timeshares. Most buyers use high-interest credit cards or expensive developer financing.

- Limited Flexibility: Hotels and short-term rentals let you change locations easily. Timeshares tie you to one spot or network year after year.

- Complex Exchange Systems: Trading your week for another location often involves fees and complicated point systems. Many owners find the process frustrating.

- Annual Cost Increases: Besides maintenance fees, other costs rise yearly with inflation. This makes long-term ownership more expensive than planned.

Limited Flexibility

The dark side of timeshare ownership hits hard with its rigid booking rules. Most timeshare contracts lock you into specific weeks or seasons each year. I learned this the tough way after buying my first timeshare property.

My family wanted to visit during Christmas, but our fixed week fell in October. Switching dates meant paying extra fees and dealing with limited availability.

Peak seasons create another headache for timeshare owners. Spring break, summer holidays, and winter getaways come with fierce competition for dates. The lease agreement often restricts last-minute changes.

Many owners face penalties for schedule changes or lose their week entirely. The points system offers some wiggle room, but you’ll still battle other owners for prime spots. Even with a deeded contract, you might end up vacationing during off-peak times just to use your share.

Long-Term Financial Commitments

Timeshare contracts lock you into decades of financial obligations. Most deals require 10 to 30-year commitments through lending agreements or lump sum payments. Your bank account takes a hit from yearly maintenance fees that often rise faster than inflation.

These fees stick around even if you stop using the property, making it tough on your checking account balance.

Many owners struggle to escape these binding contracts due to a weak resale market. Rocket Mortgage experts point out that timeshares typically lose 50% to 80% of their value right after purchase.

Unlike regular real estate or rental properties, timeshares rarely generate income or tax benefits. This financial burden often leads owners to explore timeshare exit options through legal channels.

Let’s look at how to get out of a timeshare agreement.

How to Exit a Timeshare

Getting out of a timeshare isn’t as hard as you might think. You have several paths to break free from your timeshare contract, from simple deed-back programs to working with exit companies that handle the heavy lifting for you.

Right to Cancel

Most timeshare contracts give you a cooling-off period of 3 to 15 days to cancel your purchase. This legal right lets you back out of the deal without any questions asked. I learned this the hard way after signing a deeded contract at a beach resort.

The sales team didn’t mention this right until I spotted it in the fine print.

Your right to cancel extends beyond the cooling-off period if the sales team used shady tactics. Bank of America and other lenders suggest keeping all paperwork from your timeshare purchase.

The law protects buyers from false promises about rental income or resort values. My buddy got his contract canceled after proving the salesperson lied about maintenance fees. He documented everything through certified mail, which made his case rock-solid.

Timeshare Deed-Back Programs

Deed-back programs offer a lifeline to timeshare owners who want to end their ownership cleanly. These programs let you give your timeshare back to the resort company, much like returning a leased car.

The process works best if you’ve kept up with your payments and maintenance fees. I learned this firsthand after helping my brother return his Citi-affiliated timeshare last year.

Several major resort companies run deed-back programs as a way to help owners exit their contracts. The transfer works like a standard real estate deed change, shifting ownership from you back to the developer.

You’ll need to prove you’re current on all payments and fees. The resort then takes over the deeded property, freeing you from future financial commitments. Think of it as hitting the reset button on your vacation ownership – but not every company offers this option.

Selling the Timeshare

Selling a timeshare takes patience and smart pricing. Most owners list their units on resale platforms at 30-50% below their original purchase price. I learned this the hard way after trying to sell my beach condo timeshare last summer.

Creating a solid advertisement with clear photos and honest details about your unit makes a big difference in attracting buyers.

Your best shot at selling comes from multiple listing strategies. Post your timeshare on specialized resale websites, work with licensed real estate agents, and tap into owner forums.

The market favors buyers right now, so competitive pricing matters more than ever. Smart sellers focus on highlighting perks like prime vacation weeks or popular locations. Make sure to gather all ownership documents and maintenance fee records before listing – buyers will ask for these details upfront.

Hiring Timeshare Exit Services

Professional timeshare exit services help owners break free from unwanted contracts. These companies work directly with resorts to cancel agreements through legal channels. Many exit firms charge upfront fees between $3,000 to $10,000 for their services.

The key is picking a trusted company with solid reviews and clear pricing. Fraudulent exit companies have scammed countless owners, so research is vital before signing any contracts.

Licensed attorneys at exit companies review your timeshare deeds and leases to find legal ways out. They look for contract violations or misrepresentations during the sales process.

Most reputable firms offer money-back guarantees if they can’t terminate your agreement. The process typically takes 6–12 months to complete. Smart owners contact their timeshare company first to explore deed-back programs before hiring outside help.

Alternatives to Timeshares

Looking for a break from timeshares? Check out these smart vacation options that won’t lock you into long-term contracts.

Vacation Clubs

Vacation clubs offer a fresh take on holiday planning without the hassles of property ownership. These clubs give you access to multiple resorts and destinations through a membership system.

You pay annual fees to use different properties in the club’s network. Many clubs partner with banking institutions like Capital One and American Express to offer flexible payment options.

The system works much like a leasing agreement, where you get rights to use properties without owning them.

Your membership lets you book stays at various locations throughout the year. Most clubs charge similar fees to timeshares but provide more choices for your trips. The costs include yearly dues and booking fees for each stay.

A fact-check of vacation club benefits shows they might cost less than buying a second home. Still, paying for regular vacations often saves more money in the long run. The clubs set rules about when and how long you can stay at each spot.

Short-Term Rentals

Unlike vacation clubs with fixed memberships, short-term rentals give you total freedom. I’ve found platforms like Airbnb offer amazing flexibility for travelers. These rentals let you book exactly what you need, from condominiums to beach houses, without long-term commitments.

My experience shows short-term rentals beat timeshares in both value and options. You’ll pocket more cash by renting your property too – owners make about $924 monthly through rental platforms.

The best part? You get all the perks of a home away from home. Think full kitchens, private pools, and zero sales pitches to sit through. Plus, you’ll dodge those pesky maintenance fees that come with timeshares.

Owning a Vacation Home

Buying a vacation home gives you total control over your getaway spot. You’ll skip the $22,000 average timeshare costs and build real estate equity instead. A second homeownership lets you visit anytime without booking hassles or sharing schedules.

Your property can generate rental income when you’re not using it through short-term rentals.

Smart buyers use a heloc or variable-rate mortgage to finance their vacation property purchase. The interest payments may offer tax benefits too. Many vacation homeowners team up as tenants-in-common to split costs and maintenance duties.

This setup works better than traditional timeshares since you gain actual property ownership and potential value growth over time.

People Also Ask

What exactly is a timeshare, and how does it work?

A timeshare lets you own vacation time at a resort. Think of it like buying a slice of time – you get to use the property for a term of years. It’s different from buying a whole vacation home, since you only pay for the weeks you’ll use.

Is buying from the timeshare resale market better than buying new?

The resale market often offers better deals than new timeshare sales. Just like buying a used car, you can save big bucks. But watch out – some resorts limit perks for resale buyers, so read the fine print carefully.

Can I get a loan or refinance my timeshare?

Yes, companies like Rocket Mortgage, LLC (part of Rocket Companies, Inc.) offer loans for timeshares. But be careful – interest rates are usually higher than home loans. Many owners choose to refinance when better rates come along.

What if I want to sell my timeshare later?

Selling a timeshare can be tricky. Some folks try online auction sites, while others work with resale companies. The truth is, timeshares often sell for much less than their original price. It’s like trying to sell last year’s smartphone – the value drops fast.

References

https://www.investopedia.com/terms/t/timeshare.asp

https://www.thebrecklife.com/blog/what-is-a-timeshare/ (2024-06-26)

https://www.timesharesonly.com/blog/the-benefits-of-a-fixed-week-timeshare/

https://wesleyfinancialgroup.com/timeshare-blog/timeshare-floating-week/ (2021-01-21)

https://tug2.net/timeshare_advice/fixed-week-vs-floating-week-timeshare.html

https://digitalscholarship.unlv.edu/cgi/viewcontent.cgi?article=1147&context=thesesdissertations

https://www.bankrate.com/real-estate/eyeing-a-timeshare-find-out-how-it-works/

https://www.pacaso.com/blog/how-timeshares-work (2024-11-18)

https://www.timesharesonly.com/blog/timeshare-resale/

https://www.go-koala.com/timeshare/resources/what-is-a-timeshare-and-how-does-it-work

https://www.timesharesonly.com/blog/what-is-vacation-ownership/

https://www.fbfs.com/learning-center/the-pros-and-cons-of-owning-a-timeshare (2022-06-15)

https://www.redweek.com/resources/articles/timeshare-pros-and-cons

https://timesharespecialists.com/are-timeshares-still-worth-it/

https://www.forbes.com/sites/nextavenue/2014/09/16/buying-a-timeshare-the-pros-and-cons/ (2014-09-16)

https://acagroup.org/how-to-cancel-a-timeshare/

https://www.fidelityrealestate.com/blog/timeshare-deed-back/

https://www.aarp.org/money/credit-loans-debt/info-2020/3-ways-to-get-out-of-a-timeshare.html (2020-12-15)

https://money.usnews.com/money/personal-finance/family-finance/articles/how-to-get-out-of-a-timeshare (2024-08-27)

https://www.vacasa.com/homeowner-guides/timeshare-vs-vacation-rental

https://www.pacaso.com/blog/fractional-ownership-vs-timeshare (2024-11-21)