Have you ever caught yourself feeling like your Forex trades are more akin to throwing darts blindfolded than executing a well-thought-out plan? Trust me, it’s a common experience—and the frustration can be maddening.

But here’s an intriguing thought: with daily trading volumes soaring to $6.6 trillion, we need more than luck to claim our fair share of those profits. Enter the game-changer: algorithmic trading.

This isn’t just a techy buzzword; it’s about arming ourselves with strategies that transform haphazard wagers into thoughtfully analyzed decisions. If you’re intrigued and eager for an edge in your trading tactics, stay tuned—this guide could very well revolutionize your approach.

Key Takeaways

Forex algorithmic trading uses smart rules and computers to trade faster than humans.

When you use algorithms in forex, your trades happen quick and stick to a plan without emotions messing things up.

There are different strategies for algo trading like watching trends or using math models to predict market moves.

Before using an algorithm live, test it with past market data and fake money to avoid mistakes.

AI is making algo trading even sharper by finding patterns and price differences really fast.

Table of Contents

Understanding Forex Algorithmic Trading

Alright, so you’re curious about how to make your mark in the Forex world without getting lost in the charts all day, right? Well, let’s dive into the brainy side of things with Forex Algorithmic Trading — it’s like giving a turbo boost to your strategy while cutting out those pesky emotional hiccups that can mess with your trades.

Buckle up; we’re about to unpack how these clever little algorithms can be your secret weapon in currency combat!

Basics of Algorithmic Trading

So, you’ve heard about algorithmic trading in the forex market and wonder what’s up with that? Well, it’s like having a super-smart robot that follows your rules to trade for you—day and night.

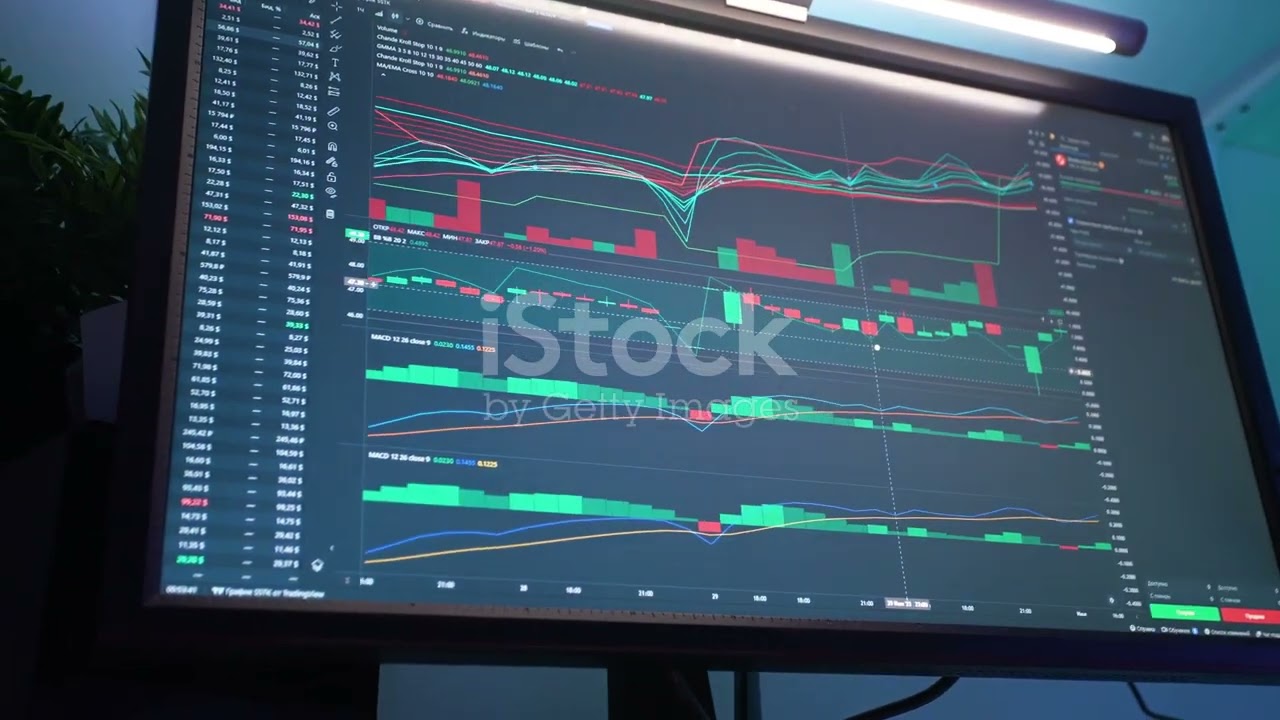

These aren’t just any old rules, though. They’re special instructions based on timing, price, quantity… you name it! And get this: computers can do all these calculations way faster than any human.

Now let’s break it down a bit more—I’m talking strategy here. Think of algorithmic trading as playing chess against someone who can think a million moves ahead. That’s because we use past market data and complex math formulas to decide when to buy or sell currencies.

It might sound like something out of a sci-fi movie, but trust me; it’s real—and some folks are making serious cash with it!

The role of Algorithms in Forex Trading

Alright, we’ve got our heads around the basics of algorithmic trading. Now let’s dig into how algorithms shake things up in forex trading. These smart programs are real game changers on the currency exchange scene.

Think about it, like having a robot buddy who never sleeps and always follows your commands—without ever letting emotions get in the way.

Algorithms work fast; they buy and sell currencies in a blink. This speed is great for jumping on opportunities or dodging losses when things get choppy in the markets. They stick to rules we set, executing trades with precision, so there’s no second-guessing or hesitation which sometimes comes when I’m calling the shots myself.

And because these algorithms cut down on mistakes and keep things moving smoothly, banks enjoy lower costs and better efficiency – that’s why they’re all over this tech! But it’s not all rainbows; automation can lead to hiccups too if not managed right, like causing prices to swing more than expected or making it tough to trade big amounts without ruffling feathers in the market.

Different Algorithmic Trading Strategies

Alright, let’s dive into the meat and potatoes—the different algorithmic trading strategies. You know, this is where things get spicy; we’re talking about setting up your trades to work like clockwork while you kick back with a cold one or hit the gym.

No need to sweat over those charts all day!

Moving average trading algorithms

So, I’ve got this buddy who swears by moving average trading algorithms. Tells me they’re like having a top-notch co-pilot in the cockpit of Forex trading. What’s cool about these algorithms is that they watch the market trends for you and adjust your moves automatically.

This means less guesswork and more doing what works.

Let me paint you a picture – imagine slicing through all those complex market waves with something as slick as a hot knife through butter. That’s what it feels like using moving averages to spot when to buy low or sell high without letting emotions trip you up.

These smart tools keep your trading sharp and on point, which is exactly what you need to score wins in the tricky world of currency hustle. Trust me, once you get the hang of it, it’s a real game-changer!

High-frequency arbitrage algorithms

I love the rush of high-frequency arbitrage algorithms. Picture this: I spot a difference in prices on two forex markets. Bang! I dive in with lightning-fast trades, buying low and selling high, all before anyone else catches on.

It’s like being a ninja in the world of currency pairs, but instead of throwing stars, I’m slinging bids and asks.

Now picture doing that hundreds of times over minutes or even seconds! That’s the thrill – squeezing tiny profits out of small price gaps that only exist for a blink. Sure, it sounds intense – because it is – but remember we’re talking about serious speed here, where milliseconds can mean money won or lost.

Okay, enough about speed; let’s talk trend-following strategies next…

Trend-following Strategies

Let’s dive into trend-following strategies. Imagine riding a wave — you want to catch it and stay on as long as possible, right? That’s what these strategies are all about in forex trading.

You look for the big moves in currency prices and hop on, hoping to make some cash before the trend changes. To do this well, you need good tools that spot those trends quickly.

Now, think of these strategies like your GPS. They guide you through the ups and downs of the market with cool technical indicators. You’re not guessing where to go next; the algorithms have got your back! And remember, just like any road trip, there can be unexpected turns — so staying alert is key.

But when done right, following those forex trends feels pretty awesome – almost like having a Forex god watching over your trades!

Index Fund Rebalancing

Talking about trends is cool and all, but let’s shift gears to index fund rebalancing. Now that’s a strategy with some muscle behind it. Index funds have one job: to match what the big market indices are doing.

It’s like they’re copying the moves of popular kids in school. But markets change, right? So index funds need to mix things up now and then to stay true to their mirror game.

Here’s how it goes down—I’ve got an index fund, say tracking the S&P 500. To keep my fund accurate—and believe me, accuracy matters—I need to buy or sell stocks whenever the S&P 500 changes its lineup.

The goal is simple: keep my assets balanced, just like the index does. This has got to be done smooth as silk, though; you don’t want your buying and selling spree throwing prices out of whack! That’d be like yelling “sale!” in a crowded mall—just chaos!

Mathematical Model-based Strategies

So, we’ve touched on index fund rebalancing and how it can work for your forex trading game. Let’s dive a little deeper with something more advanced—mathematical model-based strategies.

These bad boys are all about digging into past market data to find patterns that can predict future moves. Think of it like being a detective in the world of numbers, looking for clues that tell you when to buy or sell.

I use these strategies myself because they offer a cool way to spot opportunities based on hard evidence, not just gut feelings (let’s face it, our guts aren’t always right). Plus, using mathematical models helps me stay objective and stick to my trading plan without letting emotions mess things up.

It’s like having a secret weapon in the fierce battle of currency trading!

How to Implement Forex Algorithmic Trading

Alright, let’s get into the nitty-gritty of actually putting Forex algorithmic trading to work for us. It’s all about rolling up our sleeves and diving into the world where tech meets trades – exciting stuff, right? We’re talking choosing the right platform that doesn’t leave us scratching our heads, building an algo that could probably outpace Flash, and testing it to make sure we’re not just throwing darts blindfolded at a financial dartboard.

Stay with me here; this is where things really start heating up!

Choosing an algorithm trading platform

Picking the right trading platform is like choosing a good fishing spot – you need to know what you’re after and where to find it. I look for platforms that are user-friendly and have all the tools I need to set up my trades fast.

It’s important because, in forex trading, timing is everything. You want a platform that won’t slow you down or confuse you with too much info.

Now, reliability can’t be stressed enough – there’s nothing worse than planning the perfect trade only to have your system crash at go-time! So, I always check reviews and test how well they handle lots of action before trusting them with my hard-earned cash.

Let’s not forget about fees; some platforms sneak in charges left and right. That’s why comparing costs upfront saves me from nasty surprises later on.

Building a trading algorithm

Creating a trading algorithm is like putting together a powerful engine. You need the right parts, some technical know-how, and a clear plan.

- First, I define my goals. I think about what I hope to achieve with my algorithm. This could be capturing quick profits from small market movements or following long trends for bigger gains.

- Next, I choose my tools. Programming languages like Python or Java are essential because they let me write instructions for my algorithm.

- Then, I explore different strategies. Should my bot chase after trends or hunt for arbitrage opportunities? Each choice suits different goals and markets.

- After picking a strategy, it’s time to write the rules. My algo needs to know when to buy or sell, and setting up proper conditions is crucial for success.

- Technical indicators come into play here. Maybe I’ll use moving averages or Bollinger Bands to guide my bot’s decisions.

- Risk management can’t be ignored. It helps prevent big losses if things don’t go as planned.

- Once everything’s set up, backtesting begins. It’s like a test drive for algos—I use past data to see how it would have done in real deals without risking actual money.

- If backtesting looks good, I may do paper trading next—real – time simulation with fake money—to iron out any kinks before going live.

- Keeping an eye on market liquidity is important too, since it affects how quickly and efficiently my orders are filled.

- Finally, once I’m satisfied with all the tests, it’s time to connect to a forex broker and let the algorithm do its thing in the real world.

Testing a Forex algorithm before implementation

Alright, you’ve built your trading algorithm. Now comes a critical step—testing it to make sure it can handle the real-world market. Here’s how I do it:

- Start with historical data. I grab as much past market information as possible to see how my algorithm would have done in the past.

- Look for any bugs or errors. Algorithms are like complex puzzles; even a small mistake can mess things up big time.

- Simulate trades using a demo account. Realistic practice without risking real money? Yes, please!

- Check for overfitting. It’s like studying just the questions on the test – doesn’t work out well in new situations, right?

- Keep an eye on transaction costs. They can eat into profits if you’re not careful.

- Ensure the strategy aligns with your risk management rules. Never gamble more than you can afford to lose.

- Adjust based on the tests. Sometimes you gotta tweak a few settings here and there.

Benefits of Forex Algorithmic Trading

You know, diving into the world of Forex algorithmic trading is like finding a cheat code in a game – suddenly, you’re operating at warp speed with precision! With algorithms taking the wheel, you can say goodbye to those nail-biting moments and hello to a strategy that executes your plan without even blinking.

Increased trading speed and efficiency

Speed is key in the Forex world, just like in sports or video games. With algorithmic trading, I’m talking lightning-fast trades. This isn’t your grandpa’s fishing trip—waiting for a bite.

Nope, this is more like pressing a button and bam! The trade happens almost at the speed of light. It’s super efficient, too. No more sitting around all day staring at screens or missing out because you blinked.

This kind of fast trading means I can make more trades in less time. And it’s not just about being quick; it’s smart quick. The algorithms help me spot good deals that I might miss on my own.

They work non-stop to find opportunities, so while I’m grabbing coffee or hitting the gym, they’re making sure my money keeps working hard for me without any breaks—now that’s what I call efficiency!

Elimination of emotional and psychological factors

So, we’ve talked about how quick and efficient algorithmic trading can be. Now let’s dive into another huge plus—keeping emotions in check. You see, when I trade the old-fashioned way, it’s tough not to get caught up in the excitement or fear.

One minute I’m on top of the world because a currency is climbing, and the next I’m sweating if it takes a nosedive.

But here’s where algo trading steps in like a cool-headed coach. It sticks to the plan without getting shaky knees or an overinflated ego. There are no gut feelings or hunches in this game—it’s all about cold hard numbers and sticking to your strategy like glue.

That means I don’t second-guess myself when it’s time to make a move. My head stays clear because my algorithm does the heavy lifting without emotion—and that’s what keeps me one step ahead in this game.

Precise execution of trading plan

Getting rid of the emotional side of trading is huge, but it’s just as important to nail down your trading plan. With Forex algorithmic trading, you set up rules for entering and exiting trades.

This way, everything is clear-cut—no second-guessing yourself or hesitating.

Imagine having a GPS for your trades. That’s what an algorithm does—it follows the route you’ve set out, turn by turn (or trade by trade), without wandering off course. You decide on the strategy, like where to buy and sell, and your automated system sticks to it no matter what’s happening in the markets.

No more missed chances because you blinked at the wrong time!

The Impact of AI on Algorithmic Trading

Sure, there are risks in algorithmic forex trading, but let’s talk about how AI changes the game. AI makes things faster and smarter in the world of trading. I’m talking lightning-fast calculations that spot patterns no human could catch.

That means better decisions and more cash in traders’ pockets.

And get this: Platforms like Justmarkets are on top of this tech wave—they’ve got tools powered by AI, which can really give you an edge. So we’re not just playing with numbers; we’re using some serious machine brains to outsmart the market.

With AI, it’s like having a super-smart buddy who knows everything about forex trading – always finding those price mismatches that mean money-making opportunities for smart traders like us.

Risks Associated with Algorithmic Forex Trading

Sometimes the forex market can break into little pieces, making it hard to trade. This happens when there aren’t enough trades or people interested in buying and selling. It’s like trying to sell a toy at a yard sale, but no one wants it—tough luck, right? So, if an algorithm expects lots of action and doesn’t find it, things can go sideways.

Now, imagine you’re arm wrestling someone way stronger than you—feels unfair? That’s what it’s like with the big guns who have more info and better tech in algorithmic trading. They might see things before we do, making us feel like we’re always one step behind.

Plus, high-speed traders zoom past us so fast that they could shake up prices for everyone else—and not always in a good way.

So why even talk about this stuff? Because knowing these risks helps us stay sharp—like double-checking our gear before a hike. Next up is something cool—the brainy side of trading—the impact of AI on all this number crunching!

FAQs About Forex Algorithmic Trading

What’s Forex algorithmic trading, anyway?

It’s like setting up a smart robot to do the heavy lifting in foreign exchange markets—using computers and math (think artificial intelligence and statistical analysis) to buy and sell currencies super-fast!

Can it really make me money while I sleep?

You bet! With the right automated trading systems, you can have your own high-frequency trades happening day or night—but remember, even algorithms get it wrong sometimes.

Are those ‘expert advisors’ just for pros?

Nope, not at all! Whether you’re starting out or running a hedge fund, these handy tools use machine learning to guide your trades—like having an extra brain focused on making cash.

High-frequency trading sounds intense… is it only for big banks?

Hey now, don’t be fooled! While institutional investors love the quick pace of HFTs (high-frequency traders), with some savvy strategies regular traders can join in too—it’s not just a Wall Street game anymore.

So what’s this “support and resistance levels” chatter about?

Imagine them as invisible speed bumps and barriers in the trading world—they’re key spots where prices might pause or change direction; catching them helps pinpoint good trade opportunities.

Got any tips for staying cool when my trades go wild?

Sure thing: Just remember that “scared money never wins.” Stay level-headed with solid strategies instead of getting spooked by every dip or spike—that’s the real secret sauce!