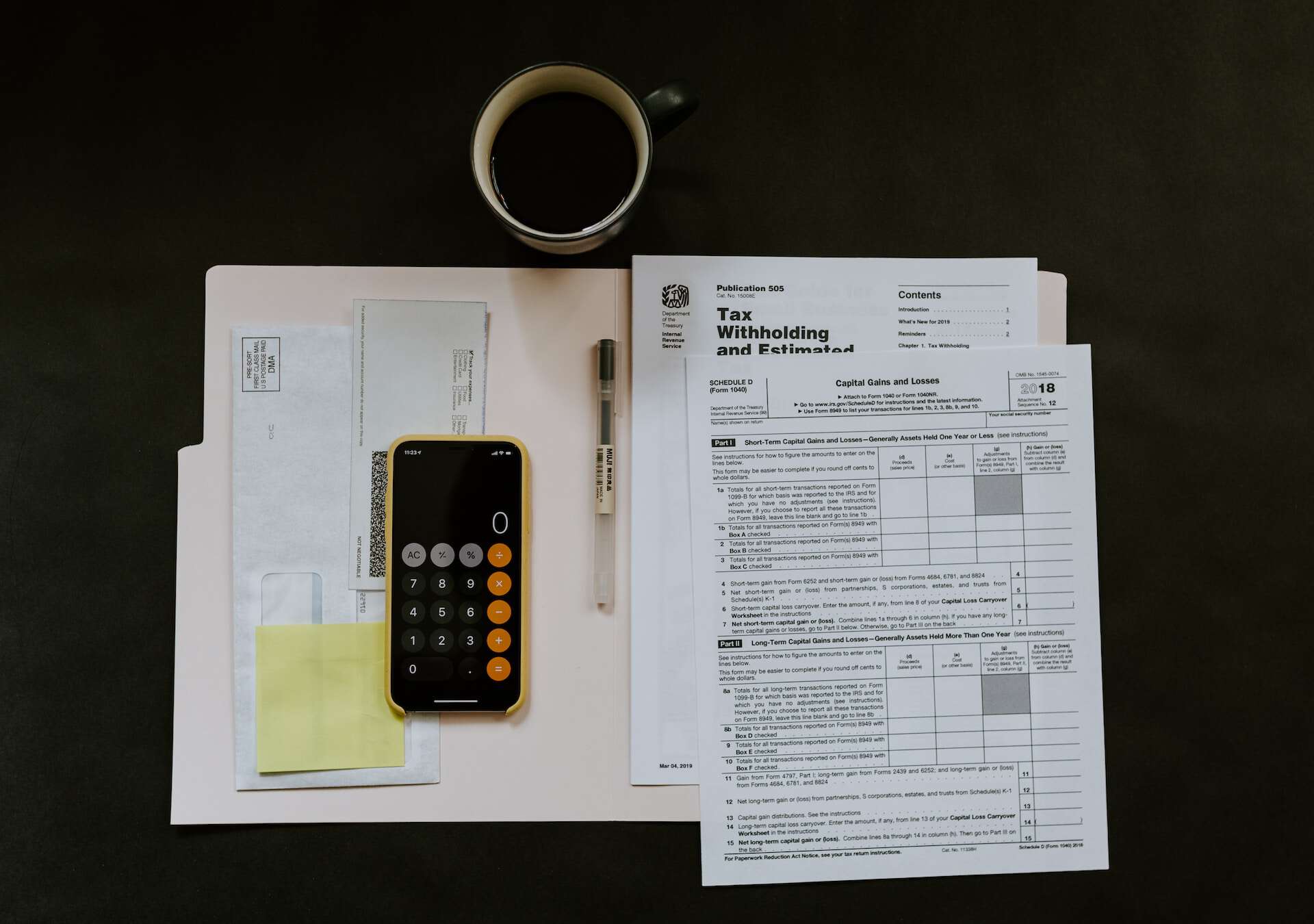

Managing personal finances is a crucial aspect of our daily lives. From budgeting to saving for the future, understanding and harnessing the power of pay stubs can significantly impact our financial well-being. Texas pay stub generator, this essential document that outlines the details of our earnings and deductions, is more than just our income records. They are the key to financial planning and can shape our financial health. This article will explore the power of pay stubs and how they can influence our finances.

Budgeting and Expense Management

Pay stubs provide valuable information about our income, including the amount we earn before and after deductions. By analyzing this data, we can create an accurate budget that aligns with our income. Pay stubs act as a reality check, allowing us to understand our actual earnings and plan our expenses accordingly. With this information, we can track our spending, prioritize essential expenses, and make informed decisions to avoid living beyond our means.

Understanding Deductions and Taxes

Pay stubs provide a breakdown of various deductions, such as taxes, healthcare contributions, and retirement contributions. Understanding these deductions is essential for managing personal finances effectively. By reviewing pay stubs, we can ensure that the correct amount is being deducted and identify any errors or discrepancies. Additionally, understanding the tax portion of the pay stub can help us estimate our tax liability and make appropriate adjustments to our financial planning.

Monitoring Income Growth

Pay stubs serve as a historical record of our earnings, allowing us to track our income growth over time. By comparing pay stubs from different periods, we can evaluate how our income has changed and identify trends. This knowledge can be empowering when negotiating salaries or seeking better career opportunities. It also helps us assess the effectiveness of our financial strategies and determine if we are progressing toward our financial goals.

Assessing Benefits and Retirement Planning

Pay stubs often provide information about employee benefits, such as healthcare coverage, retirement plans, and contributions made by the employee and the employer. Understanding these benefits is crucial for making informed healthcare, insurance, and retirement planning decisions. Pay stubs can serve as a starting point for evaluating the adequacy of our current benefits package and making adjustments to optimize our long-term financial security.

Financial Documentation and Loans

Pay stubs act as official proof of income, which is often required for various financial transactions. When applying for loans, mortgages, or rental agreements, lenders and landlords may request pay stubs to verify our income and assess our financial stability. Having accurate and up-to-date pay stubs can expedite these processes and facilitate smoother financial transactions.

Identifying Financial Leakage

Analyzing pay stubs can help us identify any financial leakage or unnecessary expenses. Reviewing the deductions section, we can spot subscriptions, memberships, or contributions that we may no longer need or need to remember about. This exercise can prompt us to reassess our spending habits and make adjustments to reduce unnecessary expenses, ultimately freeing up more money for saving and investing.

Conclusion

In conclusion, pay stubs are powerful tools that provide valuable financial insights. Understanding and utilizing the information they provide allows us to budget effectively, manage our expenses, monitor income growth, plan for retirement, and make informed financial decisions. Regularly reviewing pay stubs and using them as a basis for financial analysis and planning can have a transformative effect on our financial well-being. So, let’s harness the power of pay stubs and take control of our financial future.